Nonetheless, options players are continuing to flock to make riskier bets on the US stock market, which has been driven by a fading of worries over the election and belief that the Republicans will have a monopoly on power in Washington next year.

The bullish plays range from electric car maker Tesla (TSLA.O), to small-cap stocks and regional banks. They have played a part in the S&P 500’s rise to 3% higher since the Nov. 5 vote.

“We’ve got this relief from this big risk,” said Garrett DeSimone, head of quantitative research at OptionMetrics. ‘It’s just all round … you have absolutely everything, except for bonds, experiencing the upward trend.’

The value of options contracts also rose as options traders tried to insulate their portfolio from the potential post election turbulence including uncertainty associated with a nail biting margin of victory that could lead to a legal battle.

Most were bearish before shifting to a bullish mode, fearing to lag behind a market that has advanced after a win by Donald Trump and the Republicans who control both the houses of Congress that was expected after the election and confirmed by Edison Research on Wednesday.

The result should leave Republicans with greater freedom to advance their economic priorities, which are characterized by tax reforms and reductions of regulation.

Investors are “panicking to chase stocks at all time highs,” said Charlie McElligott, managing director of cross-asset strategy at Nomura, in a note earlier this week.

Volume on daily call options – which increase in value as stocks rise – has outpaced puts 1.5 to 1 versus 1.3 to 1 for the rest of the year, Trade Alert data indicated.

Deutsche Bank says that the net call volume in single-stock options rose significantly across most sector groups in the aftermath of the election.

More broadly, the chart on volatility has shifted significantly, the Cboe Volatility Index (.VIX), a measure of demand for insurance, has fallen to the lowest level since September, 13.67 points.

“What the volatility market was worried about failed not to happen, hence all that worry came out of the market,” said Michael Thompson, co-portfolio manager at boutique investment firm Little Harbor Advisors.

McElligott noted that the popularity in buying call options of names such as IWM.P, ARKK.P, KRE.P and SMH.O has ramped up.

The shift from worry to upside speculation was evidenced by the Tesla options, with investors flocking to call options on the stock after the election on latest fashion that Musk’s relations with Trump may prove beneficial to Tesla, the EV maker.

Tesla options were almost as large as the entire US single-stock equity options market on Monday, Nomura data revealed.

The remaining investors overall aggressiveness in bullish positions was stated to be contributing to the support of the stock price rally, by analysts.

“When you get these investors that pile in to calls … this information moves into the stock and then you see the increase in the stock itself,” says DeSimone of OptionMetrics.

TEMPERED OPTIMISM

Of course, the so-called Trump trade could be experiencing mixed signals in the future once the specifics of the timing and how the Republicans’ policy will be implemented fully will unfold. It also raised concern that certain measures in Trump’s economic agenda like the taxes cut and tariffs are inflationary.

Some of those concerns have manifested themselves in a recent rise in Treasury yields which could pose a headwind to stocks in case it continues.

Shares declined on Thursday in response to Federal Reserve Chairman Jerome Powell’s opinion that there was no need due to a robust economy. The impact of the policies of the president towards the growth of the economy will only be felt once new laws or administrative orders are passed or promulgated, he further said.

That could be one reason why some indicators of investor passion still are not as high as during other previous market upturns.

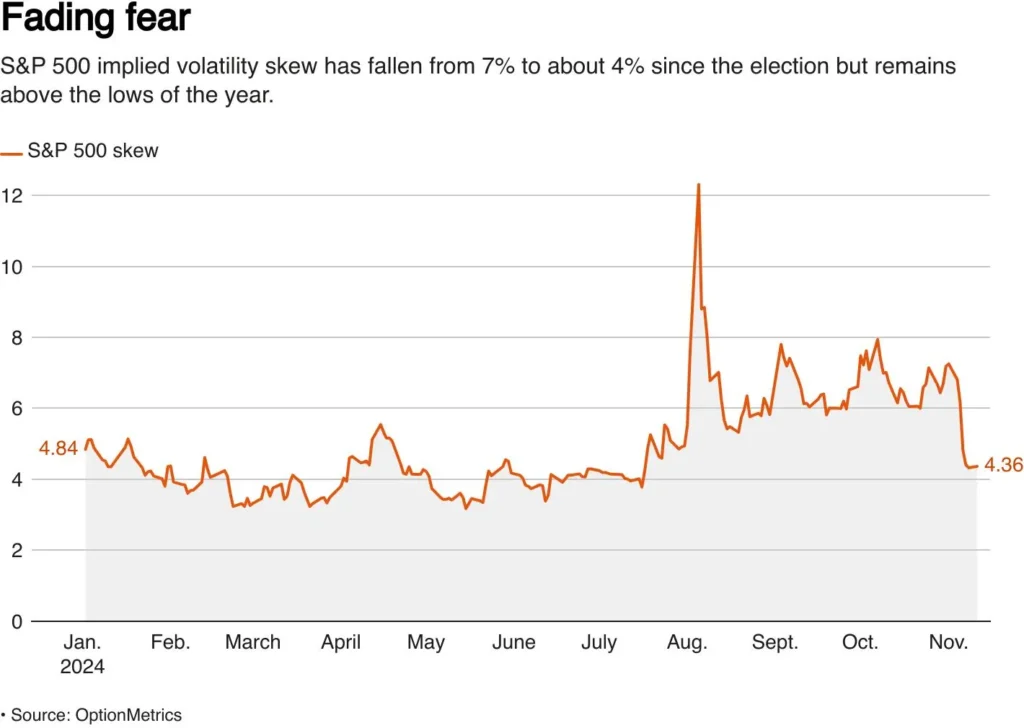

For example, one measure of S&P 500 skew, or the ratio of call options to put options, has dropped to 4 percent from 7 percent just before the election, meaning investors have become less protective of their portfolios. But it has been even lower at various times this year, including in May, when it stood at an average of just 3%.

“This means that markets are trading cautiously and not fully oblivious, as one would expect when there is no volatility,” DeSimone said.